tn franchise and excise tax guide

F. Example - Standard Apportionment - Franchise and Excise Tax for ABC LLC.

Ad The Leading Online Publisher of National and State-specific Legal Documents.

. Schedule X - Job Tax Credit. FE-9 - Extension for Filing the Franchise and Excise Tax Return. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara.

F. Schedule 170NC. The opinions expressed in the manuals are informal and do not constitute a revenue or letter ruling pursuant to the provisions of Tennessee Code Annotated 67-1-109.

F. Yourself with how these taxes apply to you. Franchise tax 25 cents per 100 or major fraction thereof of the greater of either net worth or real and tangible property in Tennessee.

65 excise tax on the net earnings of the entity and. Look through the recommendations to find out which info you will need to provide. F.

The information provided in the Departments tax manuals is general in nature. The tax guide is not intended as a substitute for Tennessee franchise excise statutes or Rules. FE Credit-5 - The Excise Tax Credit for an Entity that is Subject to the Hall Income Tax.

2 makes deliveries of Tenn. FT-3 - Proration of Franchise Tax on All Short Period Returns. Provides intrastate transportation services Financial Institutions within Tennessee.

Schedule BP - Franchise and Excise Brownfield Property Credit. Essentially the Tennessee LLC is subject to a franchise and excise tax for the privilege of doing business in their state. Click on the fillable fields and put the requested details.

Penalty on estimated franchise and excise tax payments is calculated at a rate of 2 per month or portion thereof that an estimated payment is deficient or delinquent up to a maximum of 24 of the deficient or delinquent amount. FT-1 - Franchise Tax Computation. The excerpts from the Tennessee Code are through the 2020 legislative session.

Form IE - Intangible Expense Disclosure. Open the form in the online editor. FT-1 - Franchise Tax Computation.

It is calculated from the due date of the estimated. F. General partnerships and sole proprietorships are not subject to these taxes.

Install the signnow application on your ios device. Franchise and Excise Taxes 1 Dear Tennessee Taxpayer This franchise and excise tax guide is intended as an informal reference for taxpayers who wish to gain a better understanding of Tennessee franchise and excise tax requirements. Their drama was performed in open air now its within the covered area.

F. The State of Tennessee imposes two taxes for the privilege of doing business within its boundaries. This franchise excise tax guide is intended as an informal reference for taxpayers who wish to gain a better understanding of Tennessee franchise excise tax requirements.

The minimum tax is 100. Example Franchise Tax Consolidated Net Worth Apportionment - ABC Inc. Form FAE170 Franchise and Excise Tax Return includes Schedules A-H J K M N-P R-V.

Tennessees 2015 franchise and excise tax guide provides additional information that companies operating inside and outside Tennessee should review and plan accordingly in advance of 2016. The excise tax is based on the net income of. The excise tax is based on net earnings or income for the tax year.

The excise tax is 65 of the net taxable income. At that time drama was performed only morning. The minimum franchise tax of 100 is payable if you are incorporated domesticated qualified or otherwise registered through the Secretary of State to do business in Tennessee regardless.

Penalty on estimated franchise and excise tax payments is calculated at a rate of 2 per month or portion thereof that an estimated payment is deficient or delinquent up to a maximum of 24 of the deficient or delinquent amount. These taxes are the excise tax and the franchise tax and they are imposed on corporations and most limited liability companies. The tax is based on the entitys net-worth or the book value of all real estate and taxed at the rate of 25 cents per 100 and annual minimum tax of.

Wwwtngovrevenue under Tax Resources. Racist guide to south africa Todays world is filled with technologies chemistry projects social projects but nonetheless now we have been following a thought of their stage or dais. If you had a franchise excise tax account number before May 28 2018 the only change to this number is the addition a zero to the beginning of the number.

FT-5 - Rents Included in the Franchise Tax Base May be Offset by Sub-Rental Receipts Under Certain Conditions. F. 025 per 100 based on either the fixed asset or equity of the entity whichever is greater.

FT-2 - Franchise Tax Computation on a Final Return. 67-4-2004 and 2105 goods into Tennessee that originate in. AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes.

The franchise tax is based on the greater of the entitys net worth or the book value of certain fixed assets plus an imputed value of rented property. Apportionment formula - changed apportionment formula by triple. Tennessee franchise and excise tax guide tenn.

Instant Download Mail Paper Copy or Hard Copy Delivery Start and Order Now. Excise tax 65 of Tennessee taxable income. A continuation of discussion on the various exemptions available under Tennessee Franchise and Excise tax law.

The only changes are happened genuinely. Select the form you need in our library of legal forms. Franchise and Excise Tax Return Instructions.

Each entity will file its Tennessee franchise and excise tax With regard to motor carriers substantial return reflecting only its own business nexus only exists if the carrier. FT-6 - Construction In Progress is Not. FT-4 - Indebtedness Add-Back in the Franchise Tax Net Worth Tax Base.

Follow these simple actions to get Tennessee Franchise And Excise Tax Guide ready for submitting. It is not an all- inclusive document or a substitute for Tennessee franchise and excise tax statutes or rules and. It is not an all-inclusive document.

Net taxable income starts with federal taxable income and certain adjustments are applied to arrive at net taxable income for Tennessee purposes. 123456789 New account format. Electronic Filing and Payment.

Economic nexus standard - expanding criteria under which an out-of-state vendor may incur nexus. All franchise and excise returns and associated payments must be submitted electronically. The Tennessee Franchise and Excise tax has two levels.

Tennessee Franchise Excise Tax Price Cpas

Florida Corporate Income Franchise And Emergency Excise Tax Return

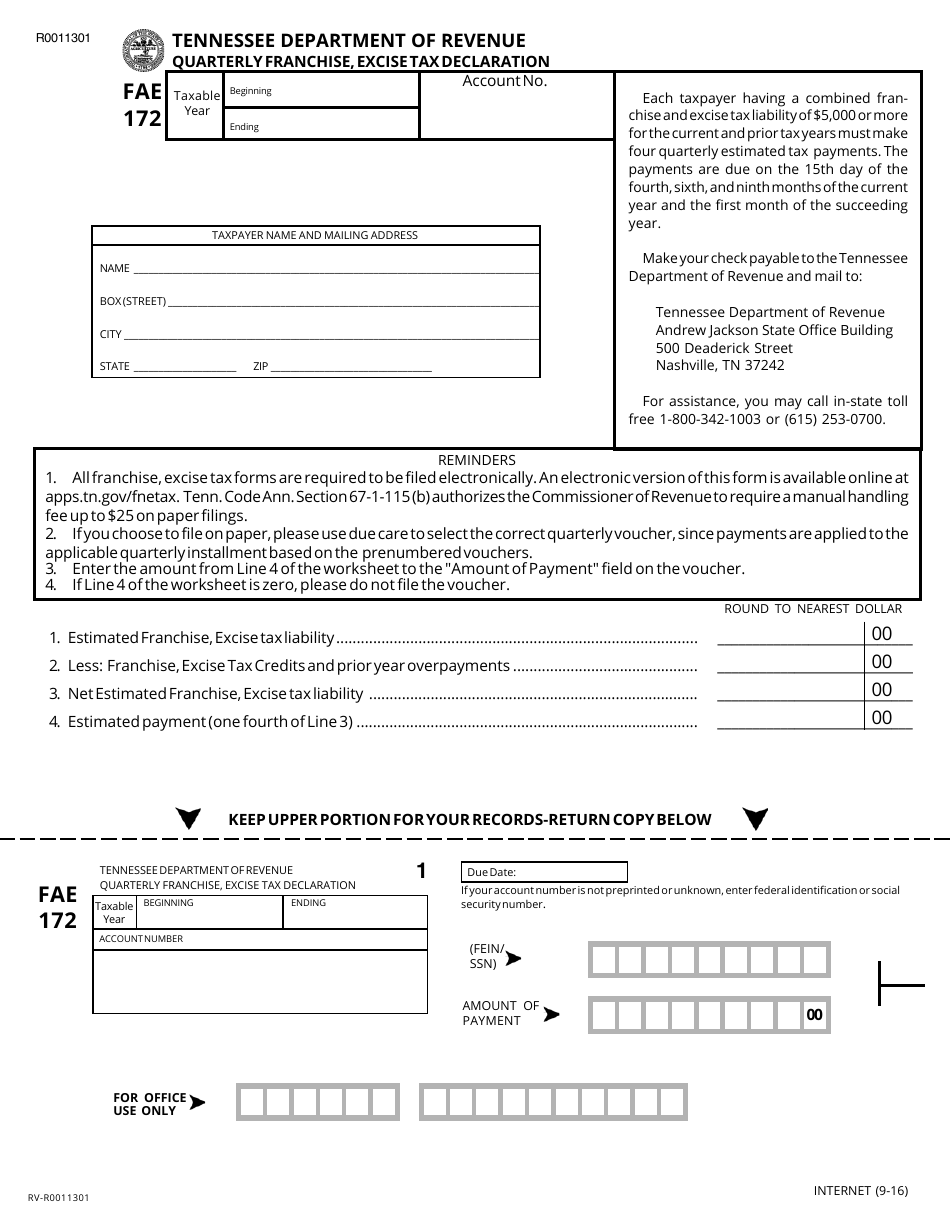

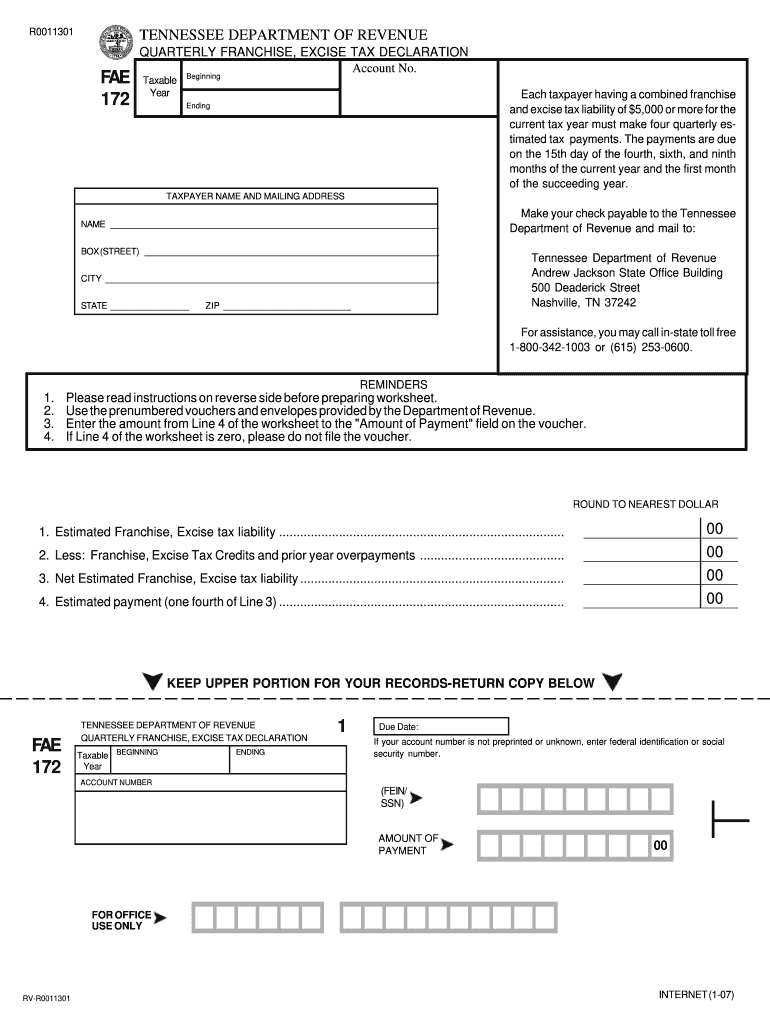

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

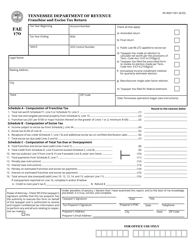

Form Fae170 Rv R0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

Fillable Online Tennessee Tennessee Department Of Revenue Franchise And Excise Tax Tennessee Fax Email Print Pdffiller

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Factors Affecting State Corporate Excise Income Tax Revenue Download Table

Free Form Fae 170 Franchise And Excise Tax Return Kit Free Legal Forms Laws Com

Get And Sign Tennessee Franchise And Excise Tax Form 2017 2022

Fillable Online Tn Tennessee Application Exemption Franchise Excise Taxes Form Fax Email Print Pdffiller

Tn Dor Fae 170 2019 2022 Fill Out Tax Template Online Us Legal Forms

2017 2022 Form Tn Dor Fae 173 Fill Online Printable Fillable Blank Pdffiller

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Tn Fae 170 Instructions 2020 Fill Online Printable Fillable Blank Pdffiller

Form Fae170 Rv R0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller